In a world where digital transformation is no longer an option, the wealth management industry is at a crossroads. It is poised to harness the power of artificial intelligence (AI) and data analytics to revolutionize how it sells financial products and services.

The global AI in the asset and wealth management market is projected to grow at a CAGR of 41.1% from 2021 to 2028.

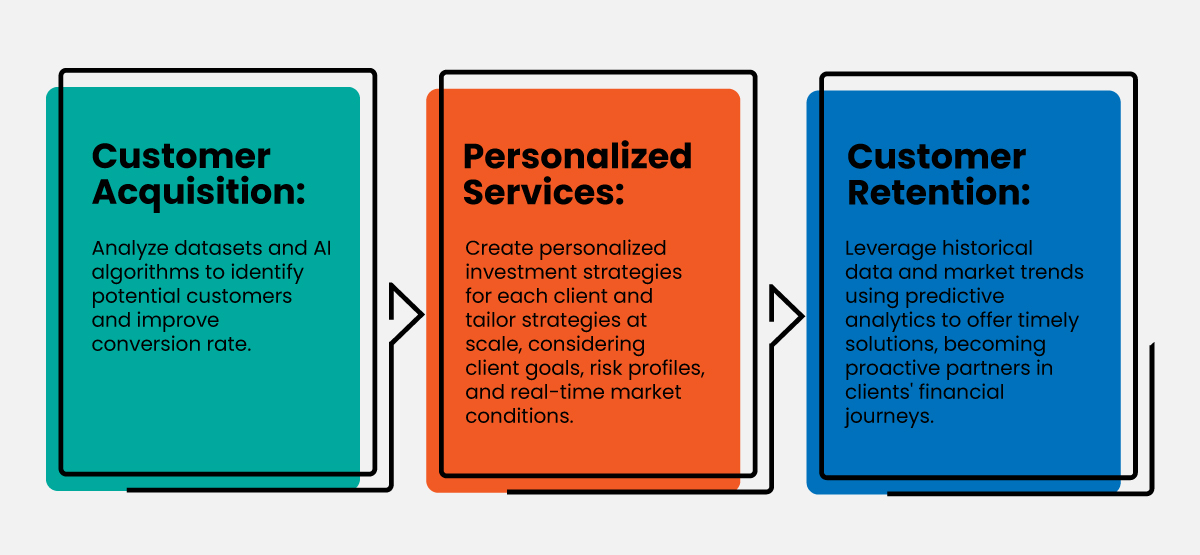

The convergence of AI and data analytics has paved the path for a new era of client engagement, personalization, and predictive insights, all critical to the growth of any wealth management firm. This is not a mere shift in the operational gears; it’s a fundamental transformation of the entire customer lifecycle—from being a prospect to retaining them.

The blog explores how the strategic integration of AI and data analytics can transform the sales landscape of wealth management, providing insights that industry professionals should consider as they steer their sales strategies toward the future.

The Current Wealth Management Landscape: What difference can AI make?

Despite its inherent complexity and regulatory constraints, the wealth management industry is evolving, driven by client expectations, competition, and technological advances. Clients now seek more than investment advice; they demand a personalized approach that aligns with their goals, values, and risk profiles. In such a dynamic setting, traditional sales methods are being outpaced by the need for real-time insights and proactive service.

In the U.S., 75% of millennials are comfortable using tech platforms for financial advice, including AI and robo-advisors.

Older sales models need more speed, scalability, and consistency in today’s environment. Wealth managers must harness the power of data and AI to understand client preferences, predict their needs, and engage with them in more effective and efficient ways.

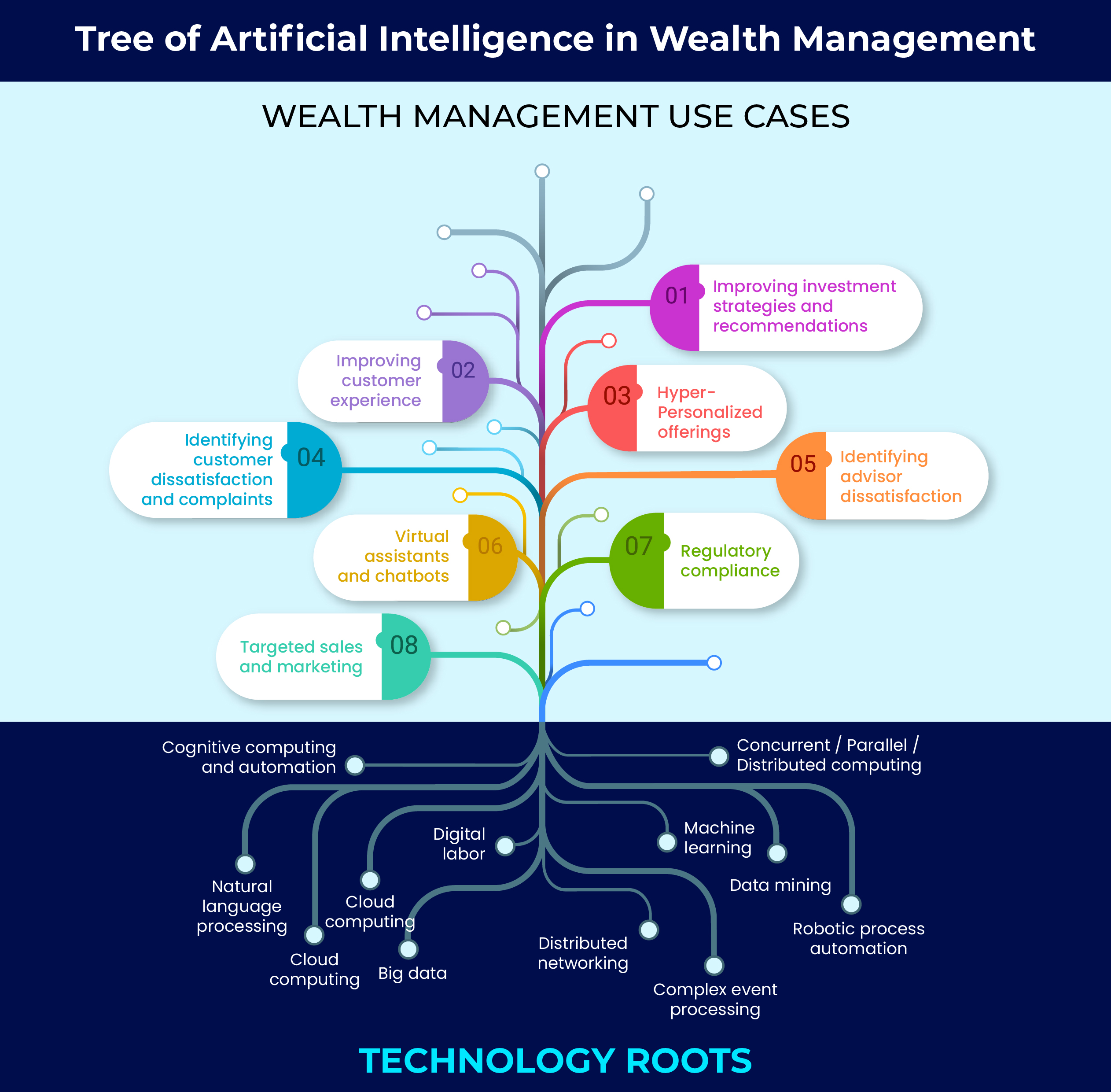

AI can now help you with your entire customer wealth handling landscape, including:

- Portfolio Management: Assess the entire client portfolio and suggest investments based on their strengths.

- Risk Assessment: Identify weaker areas where they can avoid collateral damage and safeguard their investments.

- Asset Diversification and Allocation: Provide them with a myriad of options where they can distribute their wealth.

- Tax and Retirement Planning: Provide simplified tax return computation that would help clients optimize their tax payments.

AI can do the following tasks that are usually a manual task in the traditional customer journey of a wealth management company:

Additionally, AI can automate routine tasks as part of customer retention, enabling sales teams to focus on high-value activities. The potential of AI in sales is clear: improved efficiency, increased conversion rates, and a better customer experience.

Data Analytics Driving Insights and Strategies:

A companion to AI, data analytics enables wealth management firms to extract actionable insights from the wealth of data they generate and manage. The three major KPIs in data analytics for wealth management are:

- Leveraging Big Data: From market data and demographic trends to client spending habits, the industry is loaded with information. Big data analytics tools can distill this torrent into strategic insights, revealing opportunities for growth and threats to be mitigated.

- Predictive Analytics: Where traditional analytics end at the edge of the present, predictive analytics powered by AI leap ahead, forecasting market behavior and identifying potentially lucrative investment opportunities. For sales strategies, this intelligence can inform which products to prioritize and which segments of the market to target.

- Real-Time Decision-Making: In a world where markets can shift dramatically in minutes, making investment decisions in real time is a significant advantage. Data analytics tools provide up-to-the-minute insights, allowing wealth managers to capitalize on opportunities and protect portfolios from sudden downturns.

Client-Wealth Manager Relations: Overcoming Challenges

While the benefits of AI and data analytics in wealth management sales are clear, the industry needs to be aware of possible challenges. Technology doesn’t just change the mechanics of sales; it alters the very nature of the relationships between clients and their wealth managers.

Ensuring Data Privacy and Security

To build trust with clients, wealth management firms must prioritize data privacy and security. Anonymizing data, ensuring compliance with regulations such as GDPR, and implementing stringent security measures are essential steps to safeguard client data. As wealth managers gather and analyze more customer data, it’s equally critical to establish and maintain ethical practices to protect client privacy and ensure data security.

Addressing Algorithm Biases

AI tools are only as good as the data they learn from, and biases in this data can lead to biased outcomes. Ongoing monitoring and adjustment of AI algorithms are necessary to reduce biases and ensure fair treatment of all clients. Data can inform decisions, but it cannot build relationships. The onus is still on wealth managers to use their insights wisely to foster trust and add a personal touch that no algorithm can replicate.

Balancing Human and AI Capabilities

Digital channels have reshaped how customers expect to communicate with their financial advisors. However, wealth management sales are inherently complex, often requiring a human touch to address nuanced issues. AI should be seen as a complementary tool that enhances the capabilities of sales professionals rather than a replacement for their expertise and judgment.

Case Study: Our Successful AI Implementation

We helped one of our clients leverage predictive analytics, AI, and ML models to automate their services and ensure customer satisfaction.

The client, a leading financial services company in San Francisco, struggled with inefficiencies in loan application verification, slow approval workflows, manual data preparation, and a lack of predictive loan eligibility assessment. These challenges resulted in delays, inaccuracies, and increased operational workload.

To address these issues, we conducted in-depth Exploratory Data Analysis (EDA), balanced the dataset using SMOTE, and applied various algorithms for fitment analysis, followed by hyper parameter tuning. We employed model evaluation metrics like Accuracy and AUC to ensure effectiveness. Additionally, the interactive visualizations provided actionable insights. Our solutions led to increased efficiency through ML models, faster decision-making, and improved accuracy and predictability. We also helped to reduce manual tasks, streamline processes, optimize operational costs, and make precise loan eligibility predictions within 3-5 months, empowering proactive decision-making and enhancing their overall business performance.

The Roadmap of the Future: Use of AI in Wealth Management

A clear roadmap is essential for firms looking to explore the potential of AI and data analytics in their sales strategies. The firms that will thrive in the future are those that recognize the potential of these technologies and integrate them thoughtfully and responsibly into their sales strategies.

According to WorldMetrics Report 2024, 55% of wealth managers believe AI will play a significant role in helping assess client risk tolerance.

Remaining ahead of the curve in AI integration requires staying updated on advancements and being agile in adoption. Wealth managers should assess their readiness by evaluating technological capabilities and cultural adaptability. Choosing tools aligned with strategic goals, piloting programs, and investing in talent ensures effective utilization of AI and data analytics. Continuous improvement, adapting strategies to new developments, and measuring ROI and KPIs are essential for maintaining a competitive edge.

Conclusion

The wealth management industry stands on the brink of an exciting new frontier where AI augments human intelligence. Integrating AI and data analytics into wealth management sales is not just about increasing profits or efficiency; it’s about providing better services and guiding clients toward their financial goals. By leveraging AI in wealth management through data analytics, firms can unlock new avenues for growth, optimize their sales processes, and deepen client relationships.

PreludeSys is a digital service provider with 25 years of expertise in providing state-of-the-art B2B services in FinTech transformations. Book a personalized demo with us today.