In the dynamic realm of financial technology (fintech), data privacy challenges and legacy system constraints are more pressing than ever. The need for agile application development becomes crucial as the fintech. However, traditional financial institutions need help keeping pace.

Banks and financial entities encounter significant obstacles in managing test data for digital transformation.

My data is encrypted, is it not secure enough?

Banks and financial services organizations increasingly rely on partners to extend their offerings and reach – but this can leave them open to security and compliance risks. They need a way to share data with integrators, payment processors, FinTech providers and new distribution channel partners without creating vulnerabilities.

Why Delphix for Financial Services and Banking?

The Delphix platform offers a solution that addresses the following challenges and propels your institution toward innovation. With a DevOps data platform, the data is not encrypted or tokenized but masked and is not reversible. Delphix offers them a means to share virtualized, production-quality data with ecosystem partners while ensuring that PII and PCI information is securely masked.

Here are the common challenges with respect to the financial services sector and the list of solutions offered by Delphix:

| Industry Challenge | Solution Offered by Delphix |

|---|---|

| Legacy System and Manual Processes:

Banks have outdated, siloed systems that hinder the swift setup of testing environments. |

Quick implementation

|

| Security and Compliance Complexity:

Banks require stringent data privacy regulations and audits as part of their compliance, which impedes agility and slow application time to market. |

Reduce Compliance Risk

|

| Test Data Provisioning Delays:

Banks follow a queue-based system that results in prolonged delays in provisioning test data, hindering development timelines. |

Securely Move and Share Data

|

In addition to existing data sets, self-serve data is also available for analysis and faster adoption of data-driven technologies, including cloud and AI/ML. The Delphix DevOps platform offers the following Test Data Management (TDM) solutions:

- Rapid data delivery through Test Data APIs.

- Integrated masking for sensitive information according to security policies and data privacy regulations.

With Delphix, banks and financial institutions can innovate faster and accelerate the development and testing of disruptive fintech with fast API access to production-quality data. Data can quickly be provisioned to sandbox environments for piloting new applications, infrastructure, and regulatory compliance.

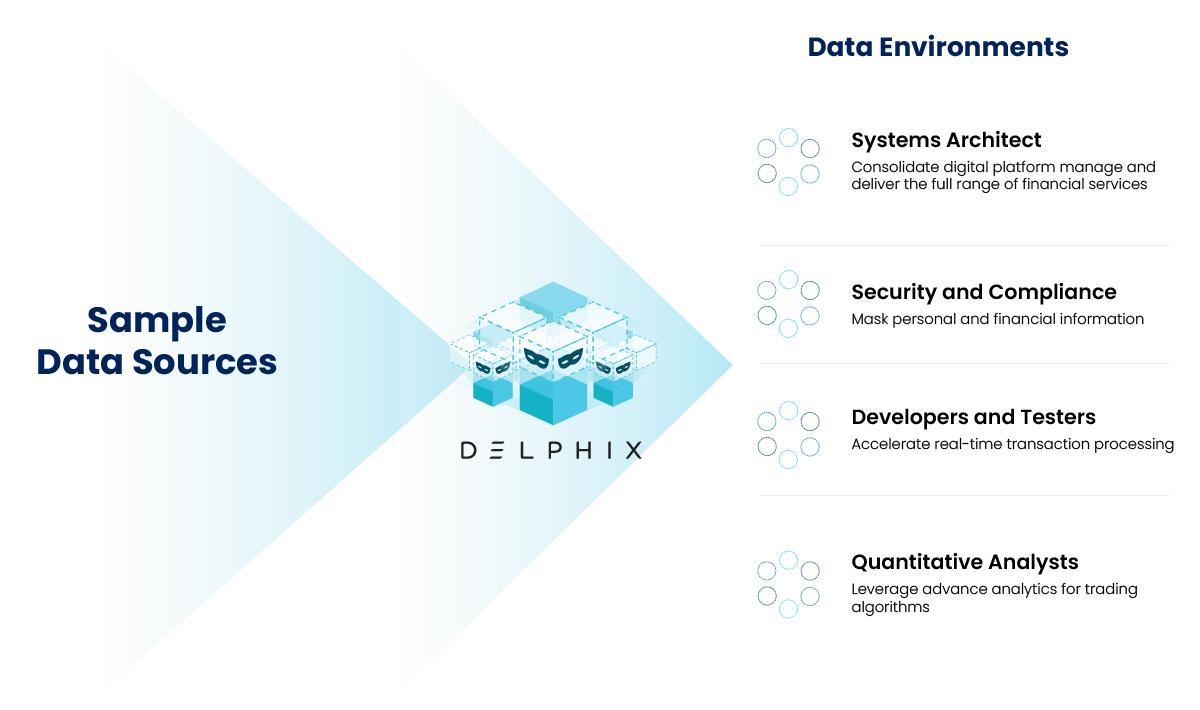

The data sources from multiple servers are masked and sent to the respective data environments with Delphix.

6 Major Delphix Compliance Capabilities for the Financial Services Sector

Delphix offers a range of advantages tailored to the needs of the financial services sector:

Accelerated Application Development: In the fast-evolving world of financial technology, Delphix empowers development teams to update legacy applications and introduce innovative fintech solutions swiftly. With API-first features, such as the ability to refresh, reset, bookmark, and branch high-fidelity virtual data copies, organizations can compete with disruptive fintech by reducing time-to-market.

Streamlined Cloud Adoption: As financial institutions embrace digital transformation through cloud technologies, Delphix simplifies data management for testing applications in the cloud. This facilitates accelerated and efficient cloud migration while ensuring security and governance through integrated masking of sensitive data. Companies can benefit from the flexibility and cost efficiencies of private, public, hybrid, or multi-cloud environments.

Enhanced Partner Ecosystem Collaboration: Financial service providers increasingly rely on partnerships to expand their offerings. Delphix enables secure sharing of virtualized, production-quality data with integrators, fintech providers, payment processors, and other ecosystem partners. This includes robust masking to protect Personally Identifiable Information (PII) and Payment Card Industry (PCI) data.

Improved Resilience and Recovery: The Delphix DevOps Data Platform maintains a comprehensive record of application data states, facilitating rapid recovery and minimizing downtime. Production support teams can deploy the latest verified data state within minutes, reducing the impact of outages on business continuity, reputation, and regulatory compliance.

Ensured Regulatory Compliance: With the financial industry’s ever-growing regulatory landscape, Delphix provides a centralized solution for managing data in compliance with regulations such as GDPR, PCI, CCPA, Dodd-Frank, SoX, and SFTR. The platform’s integrated masking capabilities and data management features ensure that sensitive data is controlled, audited, and securely delivered where needed, reducing the risk of regulatory penalties and breaches.

Optimized Infrastructure Efficiency: Delphix significantly reduces the infrastructure requirements of financial services organizations by up to 90%. This translates to substantial savings in storage and hardware resources needed to maintain non-production data environments, enabling organizations to allocate resources more efficiently while supporting innovation and growth.

In summary, Delphix empowers financial institutions to stay ahead in a competitive market by accelerating development cycles, simplifying cloud adoption, fostering collaboration with partners, ensuring resilience, meeting regulatory requirements, and optimizing infrastructure efficiency.

Discover how organizations like yours have succeeded with Delphix

(ii) Virgin Money Automates Engineering Processes, Improves Quality, and Anonymize Data.

PreludeSys: Your Strategic Partner for Fintech Transformation

PreludeSys emerges as your trusted ally, ready to pave the way for your institution’s digital transformation. Explore how our expertise can help you utilize the cutting-edge Delphix DevOps platform and can revolutionize your fintech landscape, ensuring compliance, differentiation, and accelerated growth.

Our test data management solutions accelerate compliant test data that mitigates risks and costs, empowering your DevOps teams to say “yes” to secure, rapid, scalable fintech transformation. Contact us today for our Delphix consulting services.

Note: PreludeSys is a trusted Delphix partner. The source of the content is delphix.com/blog.