Financial institutions are moving beyond just discussing the benefits of Artificial Intelligence (AI) to actively implementing it, all while ensuring regulatory compliance and maintaining customer trust. This shift comes as firms grapple with productivity challenges and the growing demand for more personalized customer experiences, with AI seen as the key solution.

Financial services are set to lead AI spending in the coming years. IDC forecasts a $632 billion global AI spending surge between 2024 and 2028, with 92% of businesses already seeing positive returns on their AI investments. AI is evolving from predictive and generative models to a new wave: “agentic AI”—intelligent agents capable of reasoning and decision-making. Salesforce’s Agentforce is a prime example of this shift.

So, what exactly are AI agents, and how can they help financial services firms grow? Let’s explore Agentforce and its potential.

Transforming financial services with Agentforce

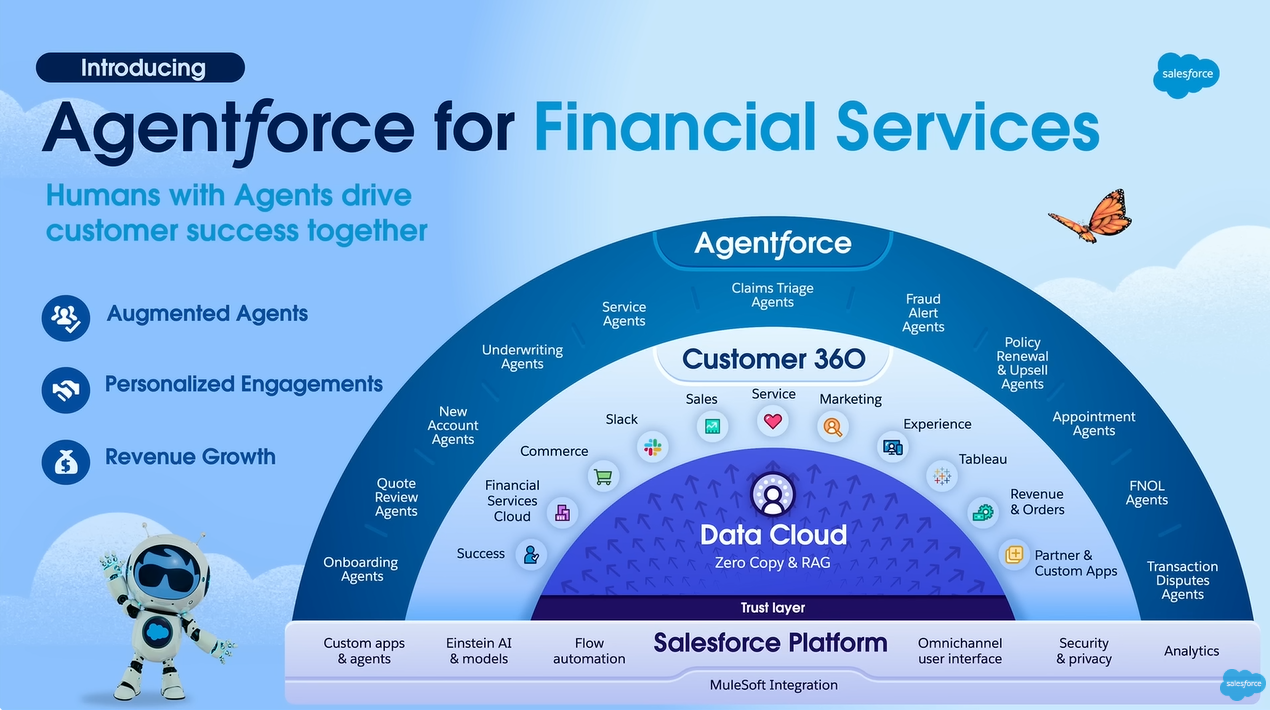

Agentforce is designed with native security and compliance controls built into a low-code, no-code platform, so you do not have to worry about complex integrations or data risks. It’s all about giving you the tools to use AI safely. Agentforce is an extension of Salesforce Customer 360, seamlessly connecting data, AI, and action into your daily workflows.

The Future of Finance: Agentforce AI Agents at Work

The Future of Finance: Agentforce AI Agents at Work

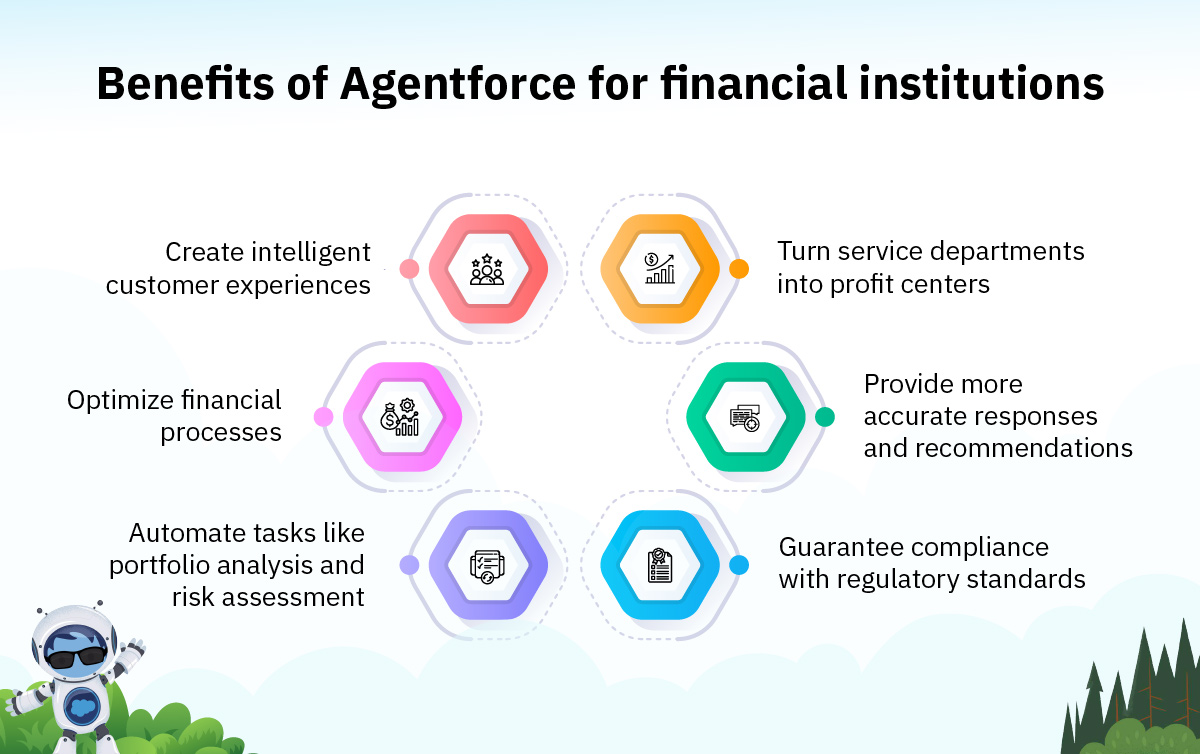

Banking: Banking agents analyze data, manage client requests, streamline operations, and provide personalized services across banking sectors with 24/7 support and simplified onboarding.

- Customer onboarding: Traditional bots in banking often rely on keyword matching and predefined patterns, which can limit their ability to handle complex or ambiguous customer queries during the onboarding process. In contrast, banking agents can streamline customer onboarding by providing personalized, efficient assistance, ensuring a smoother, faster experience that enhances customer satisfaction and accelerates account setup.

- Loan processing: Imagine you are in the middle of a loan application, eager to know your eligibility. A traditional chatbot can answer basic questions like, “What documents do I need?” but falls short regarding personalized assessments. Banking agents, however, go further by using predictive analytics to evaluate your credit score, financial history, and spending habits, providing a real-time assessment of eligibility and risk. They do not simply collect information; they offer customized loan options and instant approvals.

Wealth management: Advisor agents identify portfolio drift, generate client engagement recommendations, and automate risk assessment and report generation.

- Client portfolio management: An advisor agent could assess a client’s portfolio and recommend rebalancing based on shifts in market conditions, helping them stay aligned with their long-term objectives. If the market starts trending down, the advisor agent might alert the client and suggest safer investment alternatives to reduce risk, much like having a personal financial advisor available 24/7.

- Risk management and compliance: Advisor agents are equipped with advanced analytics and predictive modeling to scan clients’ portfolios for potential exposure to risky assets, analyze external market data, and even predict shifts in regulatory requirements. AI advisor agents automate the monitoring of transactions, flagging any potential compliance issues before they escalate. This reduces the chance of human error and ensures adherence to complex regulations.

Insurance: Claim agents help agencies manage client relationships, policy data, and claims with fast claim approval, fraud detection, and risk identification.

- Claims processing: Claim agents streamline insurance claims by providing unified data access, reducing turnaround times for a better customer experience. They can quickly verify the legitimacy of claims, such as property damage, by analyzing supporting documents and flagging discrepancies while also detecting potential fraud.

“Agentforce represents a transformative era for financial services, where intelligent agents and human expertise deliver unparalleled value, whether working together or independently. PreludeSys, your implementation partner, guides financial organizations through this evolution, enabling them to navigate the complexities of finance adeptly and with agility.” – Selva Pandian, VP Cloud Practice

PreludeSys: A preferred Agentforce implementation partner

AI agents are set to revolutionize the financial industry, enhancing customer satisfaction, delivering personalized recommendations, and efficiently solving problems while addressing data privacy concerns.

We are a globally authorized and preferred implementation partner for Agentforce. We are one of the few partners selected and enabled by Salesforce to implement Agentforce. We can help you build AI agents customized to your financial processes that seamlessly integrate with your human teams. With our deep expertise in Data Cloud and AI, we will guide you through the entire Agentforce journey, from initial planning to successful deployment and ongoing optimization.

Are you ready to transform your financial services with Agentforce? Contact us today.